In 2026, buyers don’t start with a query, they start with a belief. If you don’t shape that belief, ranking won’t save you. Most marketing advice still assumes discovery works like this:

Need → Search → Click → Compare → Decide

But that’s not how decisions feel anymore, especially in B2B. Today, people often decide what they want before they ever search. They pick a mental model, a shortlist shape, a set of “must-have” proofs, and a risk filter. By the time they type anything (or ask an AI), they’re not discovering from scratch they’re confirming a preference.

That invisible step is what I call intent formation. And if you can understand it (and influence it), you stop fighting for clicks and start winning for choice.

Search used to feel like the beginning. You had a problem. You Googled it. You clicked a few results. You compared. You decided. Now search feels more like the end. Because by the time someone types a query or asks an AI they often already carry a belief: what the problem really is, what “a good solution” should look like, what proof counts, and what risks are unacceptable. They aren’t searching to learn from scratch. They’re searching to justify a direction they already lean toward. That’s the uncomfortable truth for modern marketing:

Ranking is a confirmation channel. Intent is the real battleground.

If you lose the battle for intent, ranking higher only makes you the most visible option the buyer ignores.

What “intent” really means

Intent is the job the buyer is trying to get done, plus the rules they’ve decided matter.

- Intent (noun): a purpose, aim, or plan; an intention to do something.

- Also used as: the state of mind with which an act is done; what someone means or aims to achieve.

In marketing/search context (common usage): Intent: the goal behind a person’s action or query that they are trying to accomplish (learn, compare, buy, solve, etc.).

It’s not just “looking for X.” It’s “looking for X with these constraints, this proof, this risk tolerance, and this definition of success.” Intent includes:

- Outcome: what they want to achieve

- Context: their situation, constraints, urgency

- Success criteria: what “good” looks like

- Proof standard: what evidence they trust

- Risk filter: what could go wrong (and what they won’t tolerate)

That’s why “CRM software” is not one keyword. It’s a thousand intents.

How we form intent (and how it gets shaped)

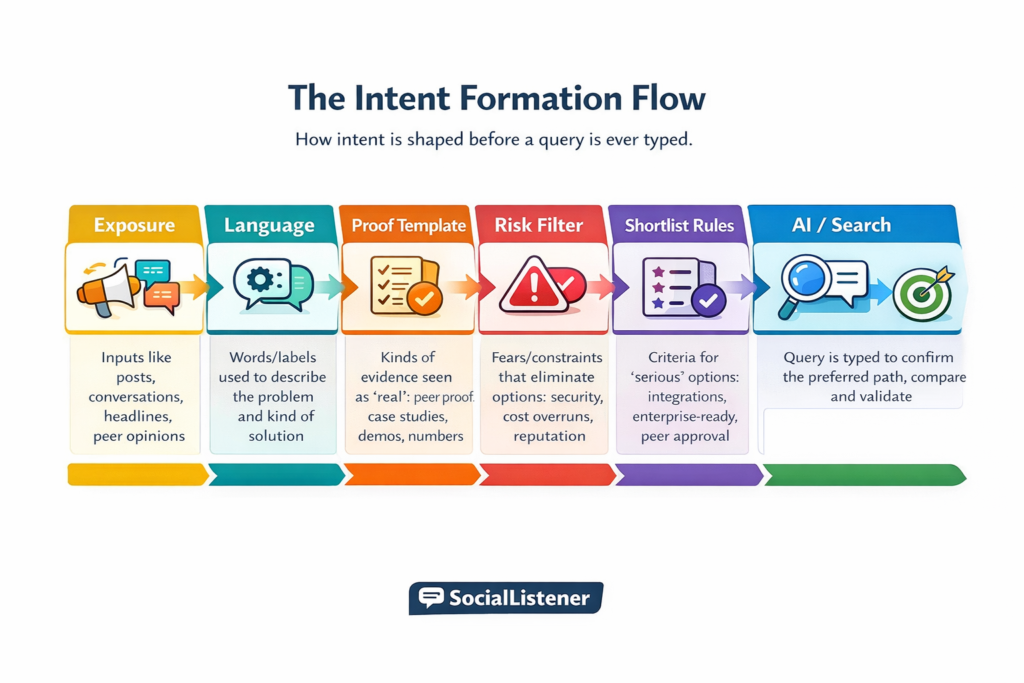

Intent forms long before a query. It forms through exposure, conversation, and repeated cues—often without the buyer realizing it. Here’s the sequence:

First, Exposure happens. A trigger shows up: a peer complaint, a creator breakdown, a community thread, an internal fire. Something makes the topic feel relevant.

Then Language forms. The buyer learns the words that frame the problem. The words become the thinking. The thinking becomes the search. If you don’t own the language, you don’t enter the shortlist.

Next, a Proof Template forms. The buyer decides what kind of evidence counts: “I need peer examples.” “I need numbers.” “I need a demo.” “I need to see how this fails.”

Then comes the Risk Filter. In B2B, risk narrows intent fast. The buyer starts eliminating options before evaluation even begins: security, adoption, integration, vendor risk, political risk.

Then Shortlist Rules appear. The buyer defines what makes a vendor “serious.” This is not rational. It’s socially constructed by peers, communities, ex-colleagues, analysts, and the stories the buyer consumes.

Only after this is formed do we reach AI/Search and it’s used mostly to confirm, compare, and gather “meeting-ready evidence.”

Finally, Decision happens often less as a personal choice and more as a consensus that feels safe.

If you’re optimizing only for “AI/Search,” you’re optimizing the last act of the play.

The critical part: intent is shaped by exposure, not by a single query. It gets shaped by:

- creator explanations that clarify the problem better than brands do

- comment threads that reveal “the real pros/cons”

- peers who normalize a shortlist (“these 3 are the only real options”)

- community war stories that create risk filters (“don’t buy X unless you have Y”)

- screenshots, demos, and “receipts” that become the proof template

This is why marketing is moving from “rank” to relevance in ecosystems.

B2B vs B2C intent: what’s different

B2C intent can be intense but it’s usually personal.

B2B intent is often political, multi-stakeholder, and risk-weighted.

B2C intent tends to be shaped by

- identity (“this is me”)

- desire (“I want it”)

- aesthetics and social proof (“others like me bought it”)

- convenience (“fast, easy, low friction”)

Proof is emotional + social (“it worked for people like me”).

B2B intent tends to be shaped by

- risk (“will this fail in implementation?”)

- legitimacy (“will this stand up in a meeting?”)

- internal alignment (“will my CFO/CIO/IT accept this?”)

- career safety (“will I look smart choosing this?”)

- integration reality (“will it fit our stack/process?”)

Proof is operational + social (“it worked in an environment like ours, and it’s defensible internally”).

Key difference: In B2B, you’re not just selling to a person. You’re selling to their future meeting.

Example:

If I had the intent to buy a data platform, I wouldn’t start by Googling “best data platform” and hoping the right answer shows up. I’d first try to clarify what I actually need—am I solving data quality, governance, analytics consistency, AI readiness, speed, cost, or all of it—and what constraints I’m operating under (stack, security, timelines, stakeholders).

Then I’d look for language and frames that help me make sense of the category: short videos, explainers, peer threads, analyst notes, and “what failed” stories that show real trade-offs. Once I have that frame, I’d define what proof I’ll accept enterprise references, measurable outcomes, a working demo on my use case, security posture, and implementation reality because in B2B I’m buying something I’ll need to defend in meetings.

After that, I’d narrow to a shortlist using practical rules (integration fit, governance depth, time-to-value, total cost, support model), and only then would I use AI/search to validate: compare vendors, read reviews, find objections, check case studies, and pressure-test risks.

Finally, I’d move into internal alignment getting IT, data teams, security, and finance on the same page because the real purchase isn’t just a platform, it’s a decision that has to survive scrutiny and adoption.

How to shape intent (without manipulating)

If intent forms before search, your job expands. You must build assets that shape:

1) The language people use to think: If buyers don’t have the right words, they can’t even search well, AI or Google.

- define the category problem in your terms (simple, repeatable phrasing)

- publish “this is what’s happening” explanations that become internal language

2) The proof template they’ll trust: B2B buyers often decide what proof counts before evaluating vendors.

- show proof in the formats people actually trust now: short walkthroughs, screenshots, teardown threads, customer voice, quantified outcomes, “what failed and why” posts

3) The shortlist rules: Most shortlists are socially constructed: peers, communities, analysts, ex-colleagues.

- publish comparison pages and decision guides that make your category legible

- make “who it’s for / not for” explicit (this builds trust and reduces risk)

4) The risk filter: In B2B, intent narrows as risk rises. People want safe paths.

- make implementation reality visible: timeline, responsibilities, pitfalls, prerequisites

- write “failure prevention content” (this is extremely underrated)

Reaching the right intent audience when AI is “taking over search”

When discovery happens through AI answers and ecosystem signals, “ranking” becomes less about pages and more about being the most citable, referenceable, and consistent source across the web. Here’s the playbook that works in practice:

A) Become easy for AI to summarize correctly: AI systems prefer content that is structured, explicit, and unambiguous. Do this:

- write clear definitions (“X is…”)

- create FAQ blocks (“If you’re wondering…, here’s the answer”)

- publish decision tables (“use A when…, use B when…”)

- avoid vague marketing claims; use specific mechanisms and outcomes

B) Win “entity clarity”: If your brand is described inconsistently across pages and profiles, AI will mangle it. Do this:

- consistent positioning line everywhere (site, LinkedIn, press, decks)

- a canonical “What we do / Who it’s for / What outcomes” page

- consistent naming for your concepts (don’t rename weekly)

C) Build third-party corroboration: AI answers borrow trust from other places: reviews, communities, newsletters, podcasts, industry roundups. Do this:

- get mentioned in industry lists (not for vanity—for retrieval)

- seed “explainers” in communities where buyers ask questions

- publish guest essays / podcasts that repeat your core framing

D) Create “shareable decision artifacts”: In the AI era, your content must travel in private. Do this:

- one-page decision guide

- comparison sheet

- ROI worksheet

- “questions to ask vendors” checklist

- a short “how to explain this internally” memo

These are designed to be forwarded.

The role of “dark” conversations (dark funnel / dark social)

In marketing, “dark” usually means private, untrackable conversations: Slack groups, WhatsApp, DMs, internal email threads, closed communities, private calls. This is where B2B decisions actually solidify. You can’t track it perfectly, but you can influence it ethically by creating assets that people want to share inside those conversations.

What wins inside dark conversations

- memorable framing: one sentence people can repeat

- defensible proof: numbers, mechanisms, customer stories

- risk reducers: “how this fails” and “how to avoid that”

- comparison clarity: what to choose and why

How to participate without being spammy

- answer real questions in communities where you have credibility

- publish “field notes” that feel like insider clarity, not promotion

- build a “champion kit” for someone inside the account (slides, FAQs, objections, security summary)

How to measure dark funnel (practical proxies)

- self-reported attribution on forms (“where did you hear about us?”)

- sales call notes (“who/what influenced you?”)

- increases in branded search / direct traffic

- spikes after community/podcast/newsletter appearances

- “forwardable asset usage” (downloads, shares, internal requests)

A simple intent model to remember

Exposure → Language → Proof template → Risk filter → Shortlist rules → AI/Search confirmation → Decision

If you only optimize the last step, you’ll always feel late.

Example:

A vendor should behave like they’re trying to shape and de-risk the buyer’s intent, not just “rank and capture demand.” That means making the category legible early publishing clear language for the problem, the trade-offs, and the “right fit / not fit” boundaries so buyers adopt your framing before they ever shortlist.

Then the vendor should build a proof system that matches how B2B trust is formed today: concrete outcomes, credible case studies, short demos that show real workflows, security/compliance clarity, and implementation reality (timelines, prerequisites, who does what).

Next, they should make comparison easy and honest—pricing ranges or packaging logic, competitor comparisons, and decision guides because buyers are comparing anyway and AI will summarize those comparisons with or without the vendor.

Finally, the vendor should design for the dark funnel: create forwardable assets (one-page “internal memo,” ROI sheet, stakeholder FAQ, security pack), show up in the places where private opinions form (communities, peer discussions, review sites), and equip internal champions with language + proof they can repeat in meetings so when the buyer finally uses AI/search to validate, the vendor’s narrative is already the “safe” answer.

The one rule to carry forward

If you want to win search later (Google or AI), you need to win intent earlier.

The best marketing in 2026 isn’t louder.

It’s the marketing that shapes how buyers think, what they trust, and what they consider “safe” before they ever ask a question.

If you’re navigating similar questions inside your organization, I’m happy to exchange notes.