B2B buying didn’t become more complex in recent years. It became more human. The biggest shift isn’t in technology, channels, or tools—it’s in where trust is formed and how risk is reduced. In 2026, most buying decisions are already emotionally resolved before they are commercially approved. The paperwork comes later. The conviction comes early.

What most teams still call a “funnel” is actually the visible tail end of a much longer, invisible process. Buyers don’t wake up wanting to talk to sales. They wake up wanting reassurance—reassurance that others like them have made the same choice and survived it. That reassurance forms in stages, most of which happen outside your CRM, your analytics tools, and your control.

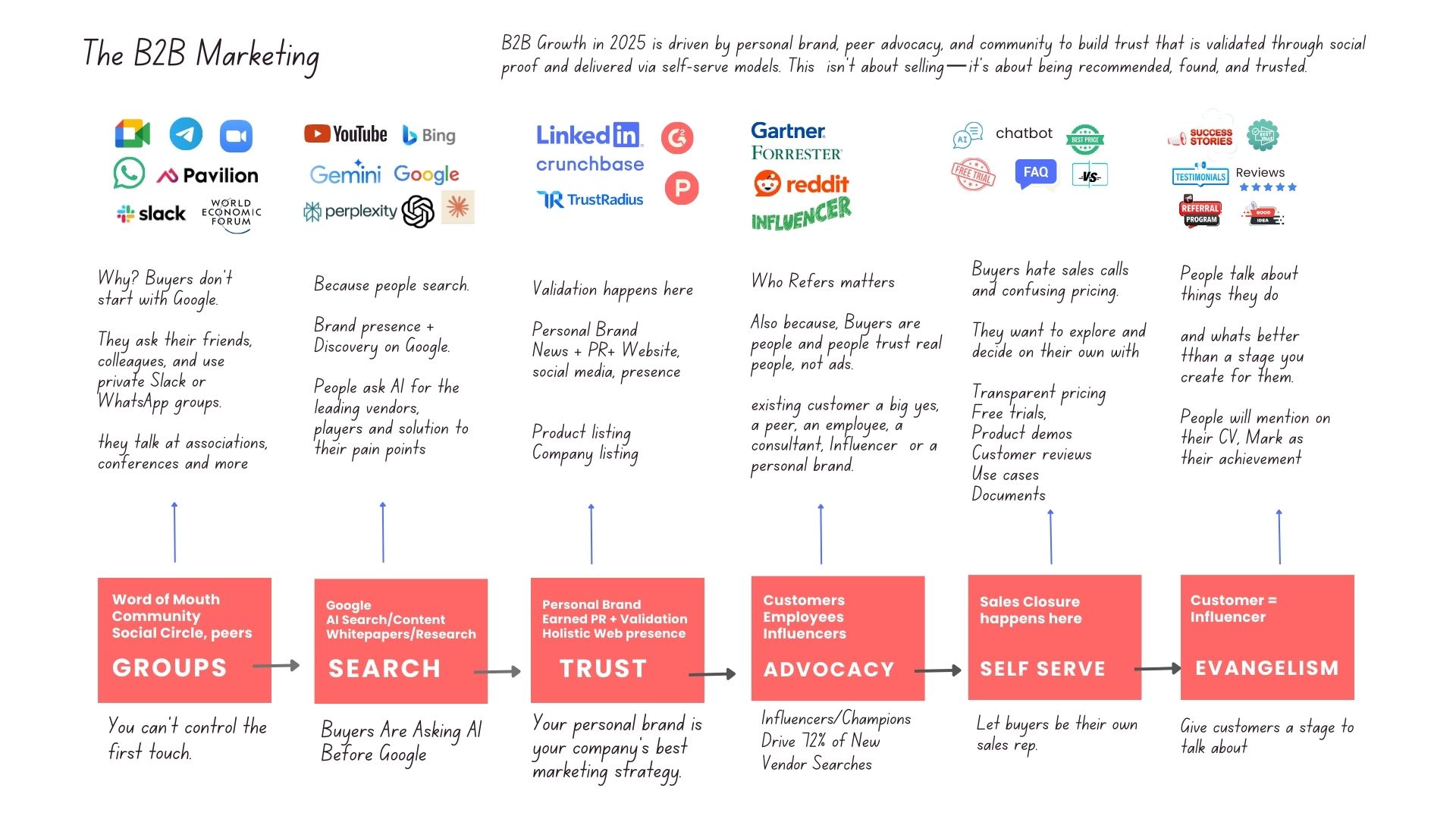

This is the real B2B Marketing growth Framework,

Step 1: Dark Conversations (The Real Starting Point)

Every serious B2B buying journey begins in what can only be described as the dark web of conversations. Not the internet’s dark web but private, unindexed, unobservable spaces. Slack communities. WhatsApp groups. Closed LinkedIn messages. Conference dinners. Peer calls. These are the places where buyers speak honestly, without vendor pressure, and without performative behavior.

Why this matters:

By the time a buyer engages with a brand publicly, they’ve often already filtered the market internally.

What the data tells us (directionally):

- ~70–80% of B2B buyers say they consult peers before engaging vendors

- Over 60% of early vendor shortlisting happens through private conversations

- These discussions are untrackable, but decisive

You cannot control this step. But you can influence whether your name comes up—and how it comes up. Brands that are absent here don’t get a second chance later.

Step 2: AI Checks & Search (Confirmation, Not Discovery)

Once a name surfaces in conversation, buyers don’t “research.” They validate. Increasingly, that validation starts with AI, before Google. Buyers ask AI tools questions like: Who are the credible vendors? Who is trusted in this space? What do real customers say? Search engines, websites, review platforms, and AI summaries now act as a collective background check.

Key shift: Search is no longer about finding options. It’s about eliminating risk.

What the data suggests:

- ~75% of B2B buyers now use AI or automated research tools in early evaluation

- Buyers consume 10–15 pieces of content before speaking to sales

- Over half of that consumption happens before any form fill

Your digital presence must now make sense to machines and humans alike. Inconsistency here creates doubt and doubt quietly kills deals.

Step 3: Validation (Do I Trust This Enough?)

Validation is where momentum either builds or dies. Buyers look for signals that reassure them this decision won’t damage their credibility. They’re not asking, Is this the best product? They’re asking, Is this a safe decision for someone like me?

This is where personal brands, leadership voice, earned media, analyst mentions, case studies, and customer proof converge into a single feeling: confidence.

Important truth: Trust is emotional, but it’s built through evidence.

Directional signals:

- ~65% of buyers say thought leadership significantly influences trust

- Peer proof outweighs product features by nearly 2:1 in late-stage evaluation

- Brands with visible leadership voices shorten sales cycles by ~20–30%

Validation is silent. Buyers rarely tell you when it’s happening. But once it fails, recovery is almost impossible.

Step 4: Referral & Advocacy (Risk Transfer)

In B2B Marketing Framework, This is where growth accelerates or stalls permanently. Referrals and advocacy work because they transfer risk. When a buyer hears “We use this” from someone credible, the decision becomes shared, not solo. Advocacy doesn’t need to be loud. It just needs to be real.

Why this step is powerful:

- Referred deals close ~2x faster

- Referral-led opportunities have higher deal sizes and lower churn

- Buyers trust people because people absorb risk together

Employees, customers, consultants, partners these voices shape outcomes far more than campaigns ever will. Advocacy isn’t a program. It’s a byproduct of trust done right.

Step 5: Sales Closure (Confirmation, Not Persuasion)

In 2026, sales is no longer where belief is created. It’s where belief is confirmed. Buyers want clarity, not pressure. They want transparency, not theatrics. They want to feel in control. Self-serve pricing, documentation, demos, and use cases now do most of the selling before sales shows up.

What’s changing in B2B Marketing.

- Buyers complete ~60–70% of their decision journey independently

- Sales involvement is later, shorter, and more technical

- Deals stall when sales tries to “convince” instead of validate

Sales closure happens when the buyer internally says, “This aligns with what I already believe.”

Step 6: Evangelism (The Growth Multiplier)

The final stage of B2B Marketing Framework, isn’t conversion. It’s expression. Evangelism happens when customers talk about your product as part of their professional identity. When they reference it in presentations. When they recommend it without being asked. When they associate it with being competent, modern, and informed. This is the only stage that compounds.

Why evangelism matters:

- Customer-led growth drives the highest-quality future pipeline

- Evangelists lower CAC indirectly by feeding Step 1 again

- The strongest brands grow through reputation, not reach

Evangelism closes the loop and restarts it.

The B2B Marketing Framework, Simplified

Dark Conversations → AI & Search Checks → Validation → Referral & Advocacy → Sales Closure → Evangelism → back to Conversations

This isn’t a funnel. Funnels assume control.

This is a trust loop, and trust cannot be forced, only earned.

The Real Competitive Advantage

The B2B growth winners of 2026 won’t be the companies with the most tactics, tools, or automation. They’ll be the ones that feel familiar before they feel persuasive. The ones buyers hear about in quiet conversations. The ones AI summarizes consistently. The ones peers recommend without hesitation.

People don’t buy products.

They buy reassurance.

And reassurance travels through people long before it shows up in pipelines.